Hi, Kirstine Openshaw here, sharing this weeks top stories with you in case Life Life’d & you missed us in your timeline(s). As always I will send out a deep dive next Tuesday so you can get a deeper look into what these mean for us, for Texas, your property equity positions & future plans.

www.OpenshawRealty.com

Universal Kids Resort in Frisco

Universal Kids have revealed the renderings of their 7 Themed Lands.

Which will be your families first to visit?

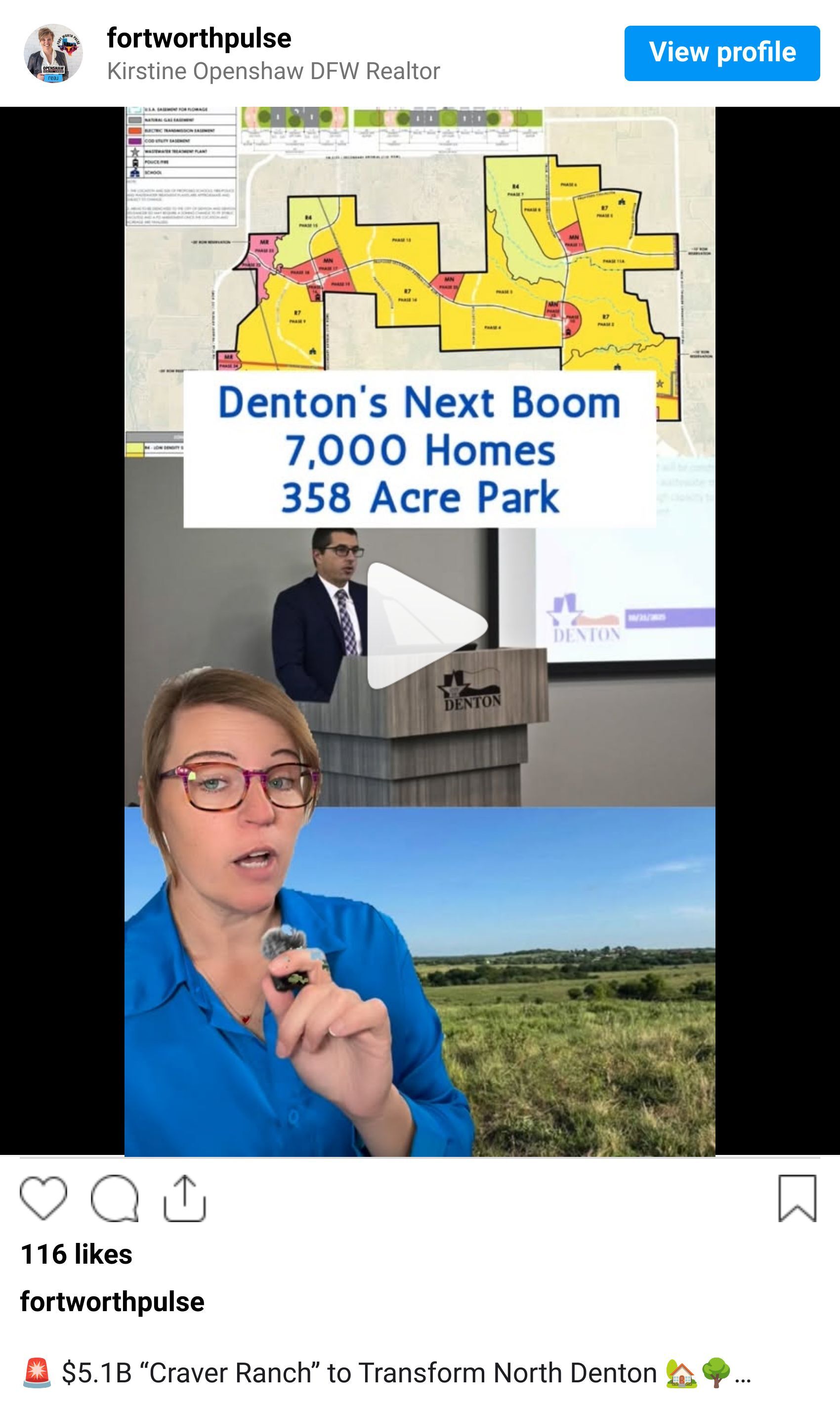

Denton’s 7,000 New Home Development

Officially in motion, this $5.1B Mega Development spans 3,870 acres in North Denton, bringing over 7,000 homes & spanning 20 years of construction.

You can see more on the video below & we will deep dive in next week’s newsletter breakdown… tell me your thoughts after watching - can we handle another development in this area right now?

Meta invests $1.5B for AI Data Center in El Paso, Texas

This 1 gigawatt facility will be supporting Facebook, Instagram & Future AI Workloads.

This officially joins them in our States AI Data Center race with facilities in Abilene, South Fort Worth & BlackRock/Nvidia’s Plano & Mansfield sites.

You can see more about it here:

MORTGAGE MINUTE

What's Happening This Week:

Big news heading into next week - there's a 90% chance the Federal Reserve cuts their Fed Funds Rate. Core inflation has held steady at 2.4% year-over-year for the past seven months, putting us close to the Fed's 2% target and setting the stage for a potential series of rate cuts as we enter the new year.

Translation: Lower rates could be coming. If you've been waiting for the right moment, this could be it.

Current Rates (National Average):

30-Year Fixed: 6.28% ↓

15-Year Fixed: 5.80% ↓

FHA: 5.90% ↓

VA: 5.90% ↓

What You Should Know:

We can close loans in two weeks or less (on qualifying programs), offer reverse mortgages for both purchases and cash-out refinances, and have access to creative solutions including broker loans for buyers who might not qualify through traditional routes. Even working this weekend to help get deals done before year-end. Schedule a call now to talk with Clive Openshaw [Close with Clive - Schedule a Call]

Why This Fed Cut Matters:

When the Fed cuts rates, mortgage rates typically follow within weeks. With inflation stabilizing near their 2% target for seven consecutive months, we're likely looking at multiple cuts, not just one. That means buyers who lock rates now could benefit, and those waiting might see even better opportunities in early 2026.

Year-End Opportunity:

Rates are down, the Fed is signaling cuts, and motivated sellers are still in the market before the holidays. This combination doesn't happen often, lower rates, less competition, and sellers eager to close before year-end.

Bottom Line: We're at a potential turning point. After months of elevated rates, the Fed is ready to cut, inflation is cooperating, and mortgage rates dropped again this week. Whether you're buying in Walsh Ranch's new $14.3B corridor, Shelton Ranch's 2,600 homes, or anywhere in Fort Worth's growth zones - now is the time to explore your options.

Want to discuss your specific situation? Reply back "CLOSE" to schedule a weekend call with Clive (yes, he's working through the weekend!), or let's explore what programs might work for your timeline before rates shift again.

Have a safe, happy weekend!

Kirstine & Clive Openshaw

www.OpenshawRealty.com